| Exam Name: | Financial Strategy | ||

| Exam Code: | F3 Dumps | ||

| Vendor: | CIMA | Certification: | CIMA Strategic |

| Questions: | 393 Q&A's | Shared By: | sylvie |

A company has:

• 10 million $1 ordinary shares in issue

• A current share price of $5.00 a share

• A WACC of 15%

The company holds $10 million in cash. No interest is earned on this cash.

It will invest this in a project with an expected NPV of $4 million.

In a semi-strong efficient stock market, which of the following is the most likely share price immediately after the announcement of the new investment?

PYP is a listed courier company. It is looking to raise new finance to fit each of its delivery vans with new equipment to allow improved parcel tracking for customers The senior management team of PYP have decided on a 10-year secured bond to finance this investment-

Which TWO of the following variables are most likely to decrease the yield to maturity of the bond?

A company's main objective is to achieve an average growth in dividends of 10% a year.

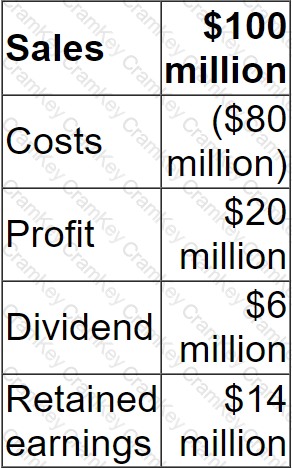

In the most recent financial year:

Sales are expected to grow at 8% a year over the next 5 years.

Costs are expected to grow at 5% a year over the next 5 years.

What is the minimum dividend payout ratio in 5 years' time that would allow the company to achieve its objective?

A venture capitalist invests in a company by means of buying

* 6 million shares for $3 a share and

• 7% bonds with a nominal value of $2 million, repayable at par in 3 years' time

The venture capitalist expects a return on the equity portion of the investment of at least 20% a year on a compound basis over the first 3 years of the investment

The company has 8 million shares in issue

What is the minimum total equity value for the company in 3 years' time required to satisfy the venture capitalist's expected return?

Give your answer to the nearest $ million