| Exam Name: | Financial Strategy | ||

| Exam Code: | F3 Dumps | ||

| Vendor: | CIMA | Certification: | CIMA Strategic level |

| Questions: | 435 Q&A's | Shared By: | ashley |

A listed company has recently announced a profit warning.

The company's share price fell 20% on the day of the announcement but had been fairly static in the weeks leading up to the announcement.

Which form of efficient market is most likely to be indicated by this share price movement?

Company A plans to acquire Company B, an unlisted company which has been in business for 3 years.

It has incurred losses in its first 3 years but is expected to become highly profitable in the near future.

No listed companies in the country operate the same business field as Company B, a unique new high-risk business process.

The future success of the process and hence the future growth rate in earnings and dividends is difficult to determine.

Company A is assessing the validity of using the dividend growth method to value Company B.

Which THREE of the following are weaknesses of using the dividend growth model to value an unlisted company such as Company HHG?

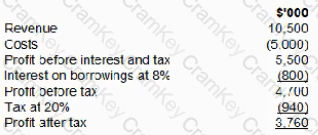

A company is considering taking out $10.000,000 of floating rate bank borrowings to finance a new project. The current rate available to the company on floating rate barrowings is 8%. The borrowings contain a covenant based on an interested cover of5times.

The project is expected to generate the following results:

At what interest rate on the floating rate borrowings is the bank covenant first breached?

A company is considering the issue of a convertible bond compared to a straight bond issue (non-convertible bond).

Director A is concerned that issuing a convertible bond will upset the shareholders for the following reasons:

• it will dilute their control

• the interest payments will be higher therefore reducing liquidity

• it will increase the gearing ratio therefore increasing financial risk

Director B disagrees, and is preparing a board paper to promote the issue of the convertible bond rather than a non-convertible.

Advise the Director B which THREE of the following statements should be included in his board paper to promote the issue of the convertible bond?