| Exam Name: | Financial Strategy | ||

| Exam Code: | F3 Dumps | ||

| Vendor: | CIMA | Certification: | CIMA Strategic level |

| Questions: | 435 Q&A's | Shared By: | giovanni |

A large, quoted company that is all-equity financed is planning to acquire a smaller unquoted company that is also all-equity financed.

The acquiring company's directors are using the dividend valuation model to value the target company before making an offer.

Relevant data for the target company:

• Dividends paid in the last financial year $2 million

• Book value of net assets $15 million

• Shares in issue 1 million

The acquiring company's cost of capital is 10%.

Its directors believe they can improve the target company's performance in the long term.

They estimate there will be no growth in the first year of the acquisition but from year 2 onwards there will be a 4% growth each year in perpetuity.

What is the maximum price the acquiring company should offer for each of the shares in the target company?

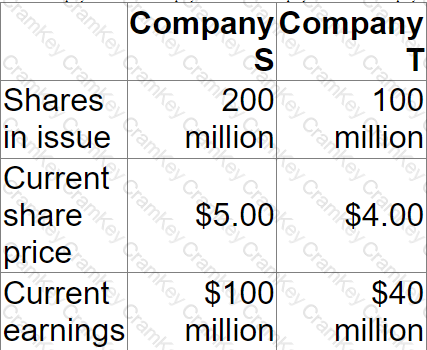

Company S is planning to acquire Company T.

The shareholders in Company T will receive new shares in Company S in an all-share consideration.

Relevant information:

The shareholders in Company T want sufficient shares to receive a 25% premium on the pre-acquisition value of their shares, based on the pre-acquisition share price.

Which of the following share-for-share offers will achieve the desired result?

A manufacturing company is based in Country L whose currency is the L$.

One of the company's products is exported to Country M, a rapidly growing economy, whose currency is the M$.

In the most recent financial year:

• 100,000 units of the product were sold to customers in country M

• The unit selling price was M$12

The spot rate today is L$1 = M$5

The company has an objective of growth in total sales value in L$ of 10% a year.

If the L$ strengthens by 5% next year against the M$, what volume of sales of this product is needed next year to achieve the objective?

The Board of Directors of a small listed company engaged in exploration are currently considering the future dividend policy of the company. Exploration is considered a high-risk business and consequently the company has a low level of debt finance.

Forecasts indicate a period of profit fluctuation in the next few years as the company is planning to embark on a major capital investment project. Debt finance is unlikely to be available due to the project's high business risk.

Which THREE of the following are practical considerations when determining the company's dividend/retention policy?