| Exam Name: | Financial Strategy | ||

| Exam Code: | F3 Dumps | ||

| Vendor: | CIMA | Certification: | CIMA Strategic level |

| Questions: | 435 Q&A's | Shared By: | noor |

A company has a covenant on its 5% long term corporate bond.

• Covenant - The earnings must not fall below $7 million

The bond has a nominal value of $60 million.

It is currently trading at 80% of its nominal value.

The projected earnings before interest and taxation for next year are $11.5 million.

The company retains 80% of its earnings. It pays tax at 20%.

Advise the Board of Directors which of the following covenant conditions will apply next year?

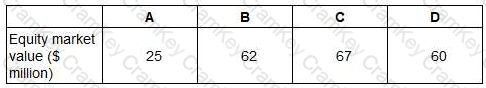

Company Z has identified four potential acquisition targets: companies A, B, C and D.

Company Z has a current equity market value of $590 million.

The price it would have to pay for the equity of each company is as follows:

Only one of the target companies can be acquired and the consideration will be paid in cash.

The following estimations of the new combined value of Company Z have been prepared for each acquisition before deduction of the cash consideration:

Ignoring any premium paid on acquisition, which acquisition should the directors pursue?

X exports goods to customers in a number of small countries Asia. At present, X invoices customers in X's home currency.

The Sales Director has proposed that X should begin to invoice in the customers currency, and the Treasurers considering the implications of the proposal.

Which TWO of the following statement are correct?