| Exam Name: | Financial Strategy | ||

| Exam Code: | F3 Dumps | ||

| Vendor: | CIMA | Certification: | CIMA Strategic level |

| Questions: | 435 Q&A's | Shared By: | elsie-rose |

Company ADE is an unlisted company; it needs to raise a significant amount of finance to fund future expansion. The directors are considering listing the company on the local stock exchange The following discussions have taken place between some of the directors:

Director A - We consider a public issue of bonds in the capital markets, we don't need to list to issue the bonds which will save time and money.

Director B - We should list on the Alternative Investment Market (AIM) and not the main market to avoid any regulatory requirements

Director C - We should remain unlisted; we can access an unlimited amount of equity finance through a rights issue

Director D - Listing will increase Company ADE's ability to raise new equity and debt finance in the future.

Director E - If we list, Company ADE will be a more likely target for a takeover than if we remain unlisted.

Which TWO of the directors' statements are correct?

A company has in a 5% corporate bond in issue on which there are two loan covenants.

• Interest cover must not fall below 3 times

• Retained earnings for the year must not fall below $3.5 million

The Company has 200 million shares in issue.

The most recent dividend per share was $0.04.

The Company intends increasing dividends by 10% next year.

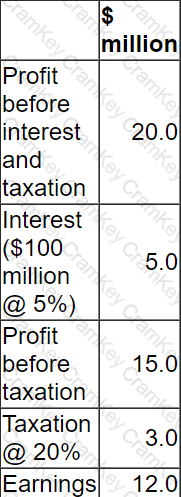

Financial projections for next year are as follows:

Advise the Board of Directors which of the following will be the status of compliance with the loan covenants next year?

A company's Board of Directors is assessing the likely impact of financing future new projects using either equity or debt.

The directors are uncertain of the effects on key variables.

Which THREE of the following statements are true?

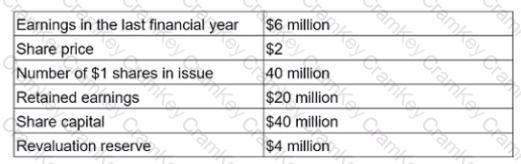

An unlisted company has the following data:

A listed company in the same industry has a P/E of 11.

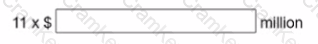

The value of the unlisted company based on the P/E of this listed company is:

Give your answer to the nearest whole number.