| Exam Name: | Financial Strategy | ||

| Exam Code: | F3 Dumps | ||

| Vendor: | CIMA | Certification: | CIMA Strategic level |

| Questions: | 435 Q&A's | Shared By: | kyla |

Which THREE of the following prevent the Purchasing Power Parity Model from operating effectively in practice?

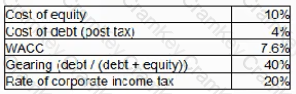

AA is considering changing its capital structure. The following information is currently relevant to AA:

The gearing rating raising the new debt finance will be 50%.

Which THREE of the following statement about the impact of AA’s change in capital structure are true under Modigliani and Miler’s capital structure theory with tax.

A company has:

• $7 million market value of equity

• $5 million market value of debt

• WACC of 9.375%

• Corporate income tax rate of 15%

According to Modigliani and Miller's theory of capital structure with tax, what is the ungeared cost of equity?

A company plans to cut its dividend but is concerned that the share price will fall. This demonstrates the _____________ effect