| Exam Name: | Financial Strategy | ||

| Exam Code: | F3 Dumps | ||

| Vendor: | CIMA | Certification: | CIMA Strategic level |

| Questions: | 435 Q&A's | Shared By: | maddie |

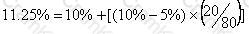

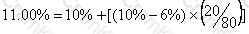

Company B is an all equity financed company with a cost of equity of 10%.

It is considering issuing bonds in order to achieve a gearing level of 20% debt and 80% equity.

These bonds will pay a coupon rate of 5% and have an interest yield of 6%.

Company B pays corporate tax at the rate of 25%.

According to Modigliani and Miller's theory of capital structure with tax, what will be Company B's new cost of equity?

A)

B)

C)

D)

Company ABC is planning to bid for company DDD, an unlisted company in an unrelated industry sector to ABC.

The directors of ABC are considering a number of different valuation methods for DDD before making a bid.

Which of the following is the MOST appropriate method for ABC to use to value DDD?

A company's annual dividend has grown steadily at an annual rate of 3% for many years. It has a cost of equity of 11%. The share price is presently $64.38.

The company is about to announce its latest dividend, which is expected to be $5.00 per share.

The Board of Directors is considering an attractive investment opportunity that would have to be funded by reducing the dividend to $4.50 per share. The board expects the project to enable future dividends to grow by 5% every year and the cost of equity to remain unchanged.

Calculate the change in share price, assuming that the directors announce their intention to proceed with this investment opportunity.

Give your answer to 2 decimal places.

$ ?

Which of the following statements about IFRS 7 Financial Instruments: Disclosures is true?