| Exam Name: | Financial Reporting | ||

| Exam Code: | F1 Dumps | ||

| Vendor: | CIMA | Certification: | CIMA Operational |

| Questions: | 248 Q&A's | Shared By: | melanie |

Country Q has the following rules in respect of capital tax on the disposal of assets:

*Capital gains are subject to tax at 25%.

*Capital losses can only be carried forward and offset against future capital gains.

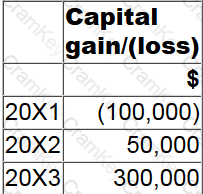

The following data relates to ABC:

How much capital tax will be payable on the capital gain recorded in 20X3?

Give your answer to the nearest $.

The financial statements of JK for the year ended 31 August 20X4 were approved on 10 November 20X4.

Within these financial statements which of the following would have been treated as a non-adjusting event in accordance with IAS 10 Events After the Reporting Period?

The external auditors have completed their audit and have discovered a material but not pervasive error in the financial statements of JK.

The directors of JK have refused to change the financial statements.

What type of modified audit report should be issued?