| Exam Name: | Financial Reporting | ||

| Exam Code: | F1 Dumps | ||

| Vendor: | CIMA | Certification: | CIMA Operational |

| Questions: | 248 Q&A's | Shared By: | annabel |

XYZ is a manufacturer. Which of these should be classified as other comprehensive income in XYZs statement of profit or loss and other comprehensive income for the year ended 31 December 20X4?

The following information relates to AA.

Extract of Trial Balance at 31 December 20X4;

Notes

(i) Inventory at 31 December 20X4 was valued at cost at $30.

(ii) The loan which was received on 1 July 20X4 is repayable in 20X9.

(iii) Corporate income tax represents an over-provision of tax for the year ended 31 December 20X3. AA reported a loss for tax purposes for the year ended 31 December 20X4 and a tax refund is expected amounting to $20.

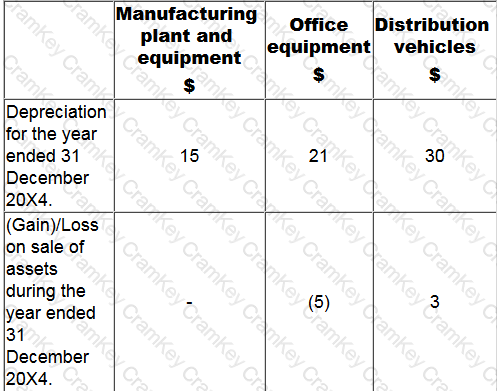

(iv) Cost of sales, administration and distribution costs need to be adjusted for the following:

Calculate gross profit for the year ended 31 December 20X4.

Give your answer as a whole $.

Statements of financial position for YZ, BC and DE at 31 March 20X2 include the following balances:

YZ purchased 90% of BC's equity shares for $508,000 on 1 January 20X2. On 1 January 20X2 BC's retained earnings were $183,000. YZ uses the proportion of net assets method to value non-controlling interest at acquisition.

YZ purchased 30% of DE's equity shares on 1 April 20X1 for $112,000. DE's retained earnings at 1 April 20X1 were $88,000.

On 1 February 20X2 YZ sold goods to BC for $28,000 at a mark up of 25% on cost. All the goods were still in BC's inventory at 31 March 20X2.

Calculate the value of inventory that will be included in YZ's consolidated statement of financial position at 31 March 20X2.

Give your answer to the nearest whole $.

The following information is extracted from QQ's statement of financial position at 31 March:

Included in other payables is interest payable of $80,000 at 31 March 20X2 and $73,000 at 31 March 20X1.

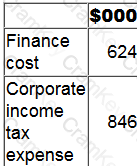

The following information if included within QQ's statement of profit or loss for the year ended 31 March 20X2.

Included within finance cost is $124,000 which relates to interest paid on a finance lease. QQ includes finance lease interest within financing activities on its statement of cash flows.

What cash outflow figure should be included as interest paid within the net cash flow from operating activities for QQ for the year ended 20X2?

Give your answer to the nearest $000.