| Exam Name: | Financial Reporting | ||

| Exam Code: | F1 Dumps | ||

| Vendor: | CIMA | Certification: | CIMA Operational |

| Questions: | 248 Q&A's | Shared By: | haleema |

Company RET's financing activities are exactly 35% of their operating activities expenses each month. Below is a list of Company RET's total expenses for this month:

Inventory supplies purchased: £145,000

Employee wages: £65,000

Purchase of a shop: £105,000

Dividend payments: ??

Cash repayments on loan: £61,000

What is company RET's total dividends payment for this month?

An entity bought a capital item for $110,000 on 1 March 20X4 incurring legal fees at the date of purchase of $2,500.

On 1 May 20X4 additional costs classified as capital expenditure by the tax rules of the country of $25,000 were incurred in respect of the asset. On 1 June 20X4 repairs not classified as capital expenditure were incurred at a cost of $15,000.

The asset was sold for $250,000 on 30 November 20X8 and costs to sell were incurred of $4,300.

Calculate the chargeable gain on the disposal.

Give your answer to the nearest $.

The accounting profit before tax of an entity was $243,200 for the year ended 31 July 20X4.

The accounting profit included disallowable income from government grants of $48,000 and disallowable expenditure of $25,600 on entertaining expenses.

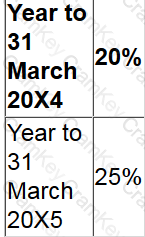

The entity also paid a $40,000 dividend to shareholders. The tax rates for the country were as follows:

Calculate the tax the entity is due to pay for the year ending 31 July 20X4.

On 31 March 20X1 OP decided to sell a property. On that date this property was correctly classified as held for sale in accordance with IFRS 5 Non-Current Assets Held For Sale And Discontinued Operations.

In the draft financial statements of OP for the year ended 31 October 20X1 this property has been included at its fair value, which was $520,000 lower than its carrying value. This has resulted in a charge to profit or loss, the result of which is that the draft financial statements show a loss of $450,000 for the year to 31 October 20X1. When the management board of OP reviewed the draft financial statements it was unhappy about the loss and decided that the property should be reclassified as a non-current asset and reinstated to its original value, despite the fact that its plans for the property had not changed.

In accordance with the ethical principle of professional competence and due care, which THREE of the following statements explain how this property should be accounted for in the financial statements of OP for the year ended 31 October 20X1?