| Exam Name: | Financial Reporting | ||

| Exam Code: | F1 Dumps | ||

| Vendor: | CIMA | Certification: | CIMA Operational |

| Questions: | 248 Q&A's | Shared By: | finnian |

In an entity's statement of profit or loss and other comprehensive income, which of the following would be presented as other comprehensive income?

An entity had a current tax liability of $187,000 in its statement of financial position as at 30 September 20X5. It was subsequently negotiated and eventually agreed with the tax authorities that the entity would pay $192,000 and this was paid on 6 January 20X6.

The entity's management estimate that the tax due on profits for the year to 30 September 20X6 is $231,000.

Calculate the entity's corporate income tax expense included in its statement of profit or loss for the year ended 30 September 20X6.

Give your answer to the nearest whole $000.

Which of the following is an example of a progressive tax?

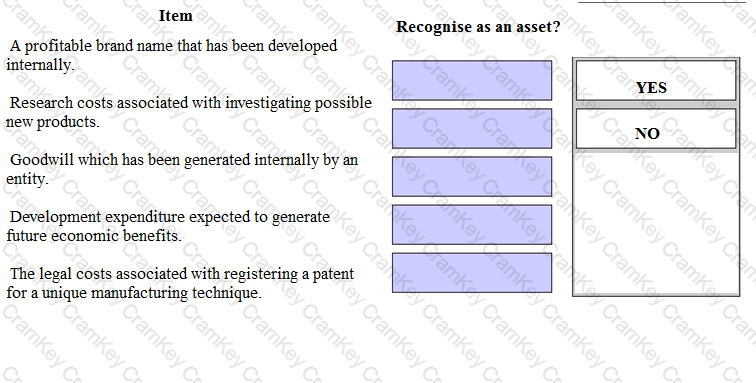

Identify from the list below which items can be recognised as assets within the financial statements of an entity in accordance with IAS 38 Intangible Assets. Place either yes or no as appropriate against each item.