| Exam Name: | Financial Reporting | ||

| Exam Code: | F1 Dumps | ||

| Vendor: | CIMA | Certification: | CIMA Operational |

| Questions: | 248 Q&A's | Shared By: | tate |

YZ has $40,000 of plant and machinery which was acquired on 1 June 20X1.Tax depreciation rates on plant and machinery are 25% reducing balance. All plant and machinery was sold for $24,000 on 1 June 20X3.

Calculate the tax balancing allowance or charge on disposal for the year ended 31 May 20X3 and state the effect on the taxable profit.

ST has $20,000 of plant and machinery which was acquired on 1 April 20X0. Tax depreciation rates on plant and machinery are 20% reducing balance. All plant and machinery was sold for $12,000 on 1 April 20X2.

Calculate the tax balancing allowance or charge on disposal for the year ended 31 March 20X3 and state the effect on the taxable profit.

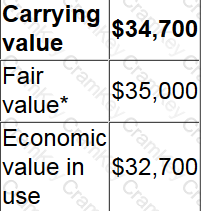

An asset has the following values:

If the asset was sold for its fair value, selling costs of $1,500 would be incurred.

Which of the following is the value of the impairment loss to be recognised for this asset in accordance with IAS 36 Impairment of Assets?

The International Accounting Standards Board's "The Conceptual Framework for Financial Reporting" identifies fundamental and enhancing qualitative characteristics of financial statements.

Which of the following is included within the fundamental characteristics?