| Exam Name: | Certified Cost Professional (CCP) Exam | ||

| Exam Code: | CCP Dumps | ||

| Vendor: | AACE International | Certification: | AACE Certification |

| Questions: | 189 Q&A's | Shared By: | teodora |

A used concrete pumping truck can be purchased for $125,000. The operation costs are expected to be $65,000 the first year and increase 5% each year thereafter. As a result of the purchase, the company will see an increase in income of $100,000 the first year and 5% more each subsequent year. The company uses straight-line depreciation. The truck will have a useful life of five (5) years and no salvage value. Management would like to see a 10% return on any investment. The company's tax rate is 28%.

Taxes due at the end of year five (5) would be:

The following question requires your selection of CCC/CCE Scenario 4 (2.7.50.1.1) from the right side of your split screen, using the drop down menu, to reference during your response/choice of responses.

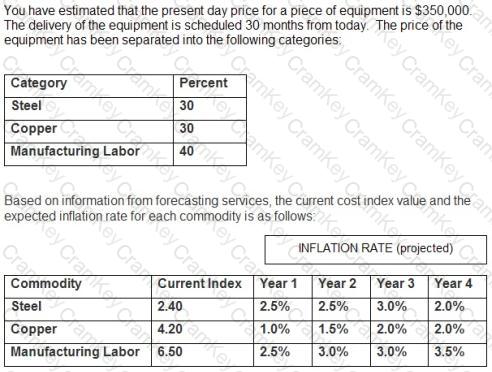

At the end of Year 4, the commodity which experienced the greatest projected percentage price index increase over today is:

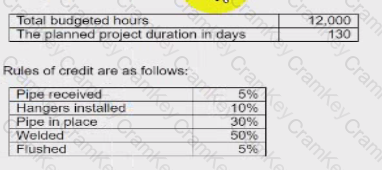

You have been hired as the cost engineer for a mechanical contractor and have been provided the following information:

What is the schedule performance index (SPI)?

Money is value Having money when you need it is very important Money can also be valuable when used wisely by knowing when to spend and when to conserve. Also. planning now for future expenses can be a plus to the company rather than a debit. There are several ways to capitalize money and spending. Basically, there is the single payment mothed that has a compound amount factor and a present worth factor. There is the uniform annual series that has a sinking fund factor, capita1 recovery factor and also the compound amount factor and present worth factor. At this point, we can assume money is worth 10%.

Which of the following is not one of the requirements to form a contract?