| Exam Name: | Certified Cost Professional (CCP) Exam | ||

| Exam Code: | CCP Dumps | ||

| Vendor: | AACE International | Certification: | AACE |

| Questions: | 189 Q&A's | Shared By: | louisa |

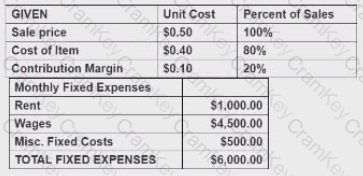

As the leas cost engineer for the XYZ Services Company, you have been requested to provide pertinent for an equipment rental decision. The unit price of the food stuffs varies, but an average unit selling process has been determined to be $0.50 cents and the average unit acquisition cost is $0.40 cents.

The following revenue and expense relationships are predicted:

If XYZ considers S550 per month the minimum acceptable net income, the number of units that will have to be sold is:

What relationship more accurately defines a situation model of parallel activities that require a partial start of one activity?

A used concrete pumping truck can be purchased for $125,000. The operation costs are expected to be $65,000 the first year and increase 5% each year thereafter. As a result of the purchase, the company will see an increase in income of $100,000 the first year and 5% more each subsequent year. The company uses straight-line depreciation. The truck will have a useful life of five (5) years and no salvage value. Management would like to see a 10% return on any investment. The company's tax rate is 28%.

Which of the following statements of the measures of central tendency is correct?

A used concrete pumping truck can be purchased for $125,000. The operation costs are expected to be $65,000 the first year and increase 5% each year thereafter. As a result of the purchase, the company will see an increase in income of $100,000 the first year and 5% more each subsequent year. The company uses straight-line depreciation. The truck will have a useful life of five (5) years and no salvage value. Management would like to see a 10% return on any investment. The company's tax rate is 28%.

The value of the truck at the end of year five (5) would be: