| Exam Name: | Fundamental Payroll Certification | ||

| Exam Code: | FPC-Remote Dumps | ||

| Vendor: | APA | Certification: | APA Certification |

| Questions: | 145 Q&A's | Shared By: | imran |

When a payer receives a “B” Notice, it must send a copy of the notification to the payee within:

Which of the following data elements is needed to calculate an employee’s net pay from gross pay?

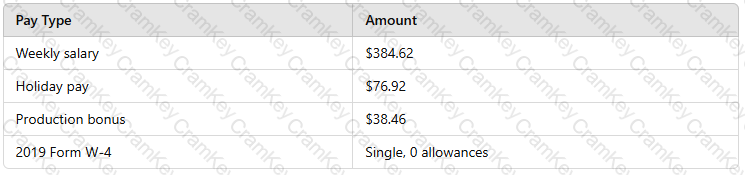

Using the percentage method for automated payroll systems, calculate the federal income tax withholding based on the following information: