| Exam Name: | Management Accounting | ||

| Exam Code: | P1 Dumps | ||

| Vendor: | CIMA | Certification: | CIMA Operational |

| Questions: | 260 Q&A's | Shared By: | cassius |

For the forthcoming period, the number of units of product L produced must be no more than four times the number of units of product M produced.

The equation to represent this constraint in a linear programming exercise is:

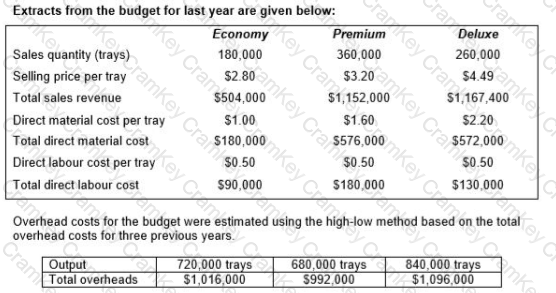

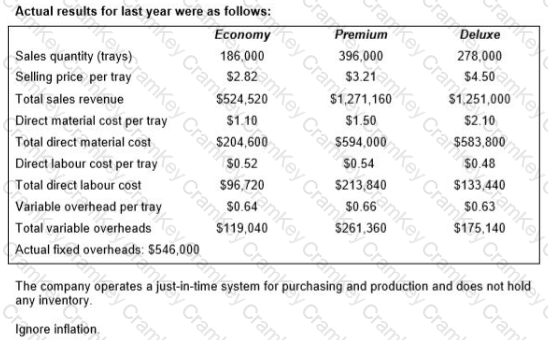

A company produces trays of pre-prepared meals that are sold to restaurants and food retailers. Three varieties of meals are sold: economy, premium and deluxe.

Calculate, for the original budget, the budgeted fixed overhead costs, the budgeted variable overhead cost per tray and the budgeted total overheads costs.

According to a decision tree forecasting, there are three possible outcomes of a project requiring £10,000 capital investment. They are (along with probability of occurring): £20,000 in revenue (45%), £35,000 (15%),

£10,000 (30%) and -£6,000 (10%).

However, choosing another project (2) requiring the same investment would give us £12,000 and choosing project 3 would give us a 90% chance of generating revenues of £15,000 but a 5% chance of revenues of £0.

Project 4 is wildly ambitious and boasts an unlikely (5% chance) of generating revenues of £100,000. There is a 10% probability of negative revenues.

Which is the risk averse investor more likely to take?

Project 1

Project 2

Project 3

Project 4

A company makes Product A and Product B. The production process for both products uses one type of material, one type of labour, and utilises one machine. All three of these resources will be limited in November. The company has performed a linear programming model and the constraints and optimal solution, to maximise contribution, are as follows:

Constraints:

For November, which of the above constraints are binding, and which are non-binding?