F2 Advanced Financial Reporting

Last Update Apr 25, 2025

Total Questions : 268

To help you prepare for the F2 CIMA exam, we are offering free F2 CIMA exam questions. All you need to do is sign up, provide your details, and prepare with the free F2 practice questions. Once you have done that, you will have access to the entire pool of F2 Advanced Financial Reporting F2 test questions which will help you better prepare for the exam. Additionally, you can also find a range of F2 Advanced Financial Reporting resources online to help you better understand the topics covered on the exam, such as F2 Advanced Financial Reporting F2 video tutorials, blogs, study guides, and more. Additionally, you can also practice with realistic CIMA F2 exam simulations and get feedback on your progress. Finally, you can also share your progress with friends and family and get encouragement and support from them.

AB acquired 10% of the equity share capital of XY for $180 million in 20X4. On 1 January 20X8 AB acquired a further 45% of the equity share capital of XY for $900 million and at that date the original investment had a fair value of $200 million.

Place the correct values in the boxes below in order to complete the consideration transferred element of the goodwill calculation on the acquisition of XY.

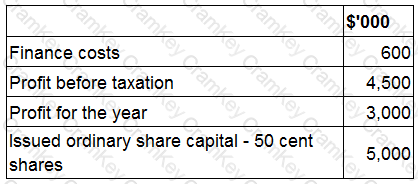

Information from the financial statements of RST for the year ended 30 April 20X9 is as follows:

At 30 April 20X9 the ordinary shares are trading at $4.75.

What is the price earnings (P/E) ratio for RST at 30 April 20X9?

When accounting for a finance lease under IAS 17 Leases, which TWO of the following are recognised in the statement of profit or loss?

AB owned 80% of the equity share capital of FG at 1 January 20X6. AB disposed of 10% of FG's equity share capital on 31 December 20X6 for $400,000. The non controlling interest was measured at $700,000 immediately prior to the disposal.

Which of the following represents the adjustment that AB made to non controlling interest in respect of the disposal when it prepared its consolidated financial statements at 31 December 20X6?