| Exam Name: | F2 Advanced Financial Reporting | ||

| Exam Code: | F2 Dumps | ||

| Vendor: | CIMA | Certification: | CIMA Management |

| Questions: | 268 Q&A's | Shared By: | cadi |

ST owns 75% of the equity share capital of GH. GH owns 80% of the equity share capital of RS.

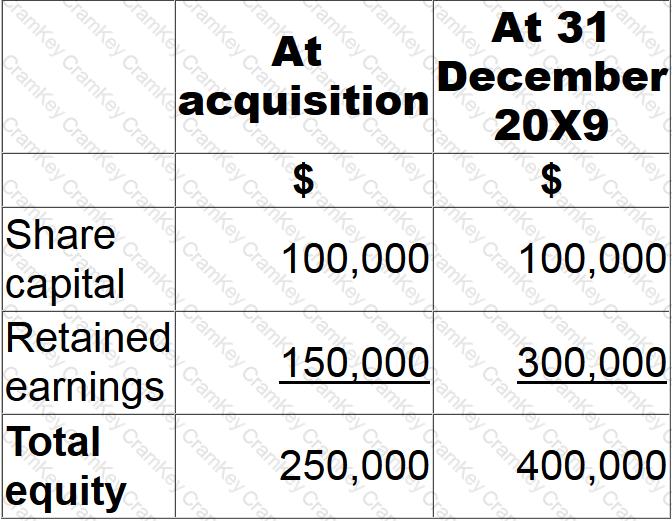

The following balances relate to RS:

The non controlling interest in respect of RS had a fair value of $56,000 at acquisition. There has been no impairment to goodwill since acquisition.

What value should be included in ST's consolidated statement of financial position for the non controlling interest in RS at 31 December 20X9?

HJ is currently in dispute with an employee, who is claiming $400,000 in a legal case against them.

HJ's legal advisors have stated that it is probable that they will lose the case and will have to pay the amount claimed.

Also, HJ are claiming $250,000 from a supplier of defective goods and the legal advisors have stated that it is probable that HJ will be successful in this claim.

What is the correct accounting treatment for these two items in HJ's financial statements?

Information from the financial statements of an entity for the year to 31 December 20X5:

The gearing ratio calculated as debt/equity and interest cover are:

LM acquired 80% of the equity shares of ST when ST's retained earnings were $50 million. The fair value of the net assets of ST included a contingent liability with a fair value of $100 million at the date of acquisition and a fair value of $40 million at 31 December 20X6. No other fair value adjustments were required at the date of acquisition.

LM and ST had retained earnings of $200 million and $80 million respectively at 31 December 20X6.

The consolidated retained earnings of LM at 31 December 20X6 were: