| Exam Name: | ArchiMate 2 Combined Part 1 and 2 Examination | ||

| Exam Code: | OG0-023 Dumps | ||

| Vendor: | The Open Group | Certification: | ArchiMate 2 Certified |

| Questions: | 103 Q&A's | Shared By: | elise |

Scenario

Please read this scenario prior to answering the question

ArchiSurance has entered into a legal agreement to acquire ArchiSpecialty, a specialty insurer that has several lines of business, including insuring organizations that conduct high-stakes contests. Prior to entering into this agreement ArchiSurance staff carefully examined the ArchiSpecialty Enterprise Architecture to develop an integration plan with four successive phases. Each phase of the plan provides a stable foundation for ArchiSurance to conduct its newly expanded business while making significant progress toward the targeted integration of ArchiSpecialty operations. The first phase of the plan, Common Ownership, will begin on the acquisition date specified in the legal agreement. The second through fourth phases will begin after their predecessors are complete.

During the Common Ownership phase, the two companies' websites will be linked to each other and their Interactive voice response(IVR) system menus will be integrated. During the second phase, known as Integrated Organizations, the corresponding ArchiSurance and ArchiSpecialty departments will be combined and all financial processing will be migrated to the original ArchiSurance systems. In the third Phase, known as Integrated Customer Operations, ArchiSpecialty customer relationship management (CRM) data will be migrated to the corresponding ArchiSurance applications. In the fourth and final phase, known as Integrated Operations, the ArchiSpecialty claims data will be migrated to the corresponding ArchiSurance applications. However, the ArchiSpecialty underwriting solution for high-stakes contests will be retained due to its unique capabilities.

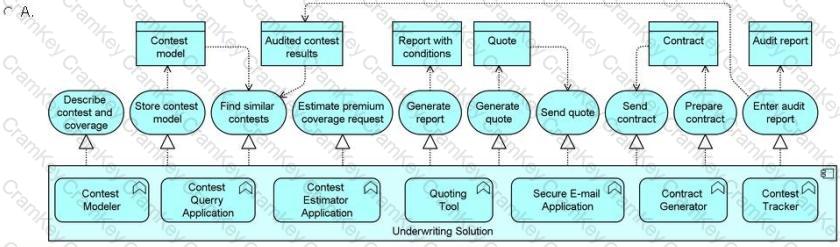

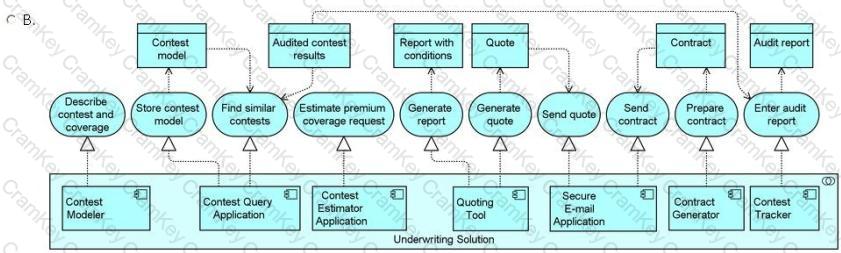

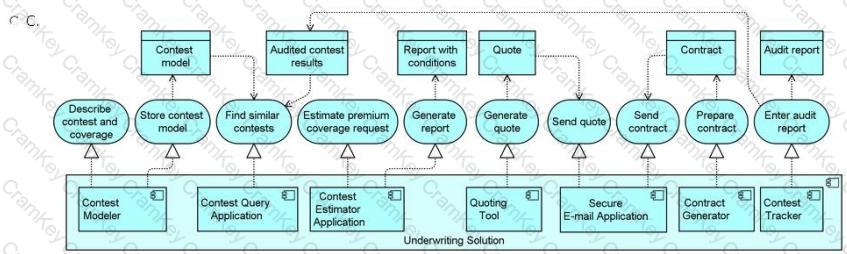

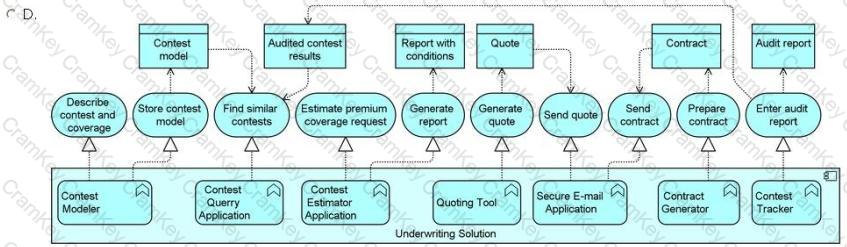

The underwriting solution for high-stakes contests assists underwriters in creating a policy to insure against the possibility of a contestant winning an improbable but expensive award, such as $1 million US for hitting a hole-in-one on a golf course, or a luxury world cruise for a winning spin of a roulette wheel. In return for a single premium payment, the insurer agrees to pay the award if a contestant earns it fairly. When an underwriter receives a request for an insurance quote, either from a promotions company that isplanning the contest or from a company with its own promotions department, he uses the Contest Modeler application to precisely describe the planned contest and the coverage requested, and to store the contest model in a machine-readable format. Then, the underwriter uses the Contest Query application, which reads the contest model and queries a collection of audited contest results to find records of similar contests. Then, the underwriter uses the Contest Estimator application to estimate the premium for the coverage request, and also to produce a report with a recommended set of conditions to provide with the quote. After consulting the report, the underwriter uses the Quoting Tool application to prepare a quote for the customer. Then, the underwriter sends the quote to the customer via secure email. If the customer accepts the quote, the underwriter uses the Contract Generator to prepare t contract for the customer, which he also sends via secure email. In the contract, the customer agrees to employ a contest auditorwho will report the audited results of the contest regardless of whether prizes are awarded. The underwriter uses the Contest Tracker application to add these reports to the collection of audited contest results. Note that all reports are delivered in a standard markup language that can be read by other software programs and either processed in the background or rendered visually.

Refer to the Scenario

The ArchiSurance chief information officer has asked you to explain the unique suite of applications that ArchiSpecialty uses to underwrite high-stakes contest insurance. You must model these applications, the services they provide and the data they access.

Which answer provides the best explanation?

Scenario

Please read this scenario prior to answering the question

Independent insurance brokers that work with ArchiSurance have complained of difficulty in communicating with salespeople and other personnel at ArchiSurance. They have said that email is too clumsy and slow for working on urgent deals, people do not always answer their mobile phones, and it is difficult to tell whether an individual is available. They have also complained that it is too time-consuming for them to manage their commission payments using an older web application that requires them to print out and mail forms for making some routine changes, and also does not work on many mobile devices. Some brokers have said that it is easier to do business with ArchiSurancecompetitors that provide easy-to-use mobile applications for both general communication and commission management. In fact, the ArchiSurance Vice President of Sales and Chief Marketing Officer have both expressed concern about reports from the ArchiSurance market research department that the company is gradually losing market share with some of the same brokers that have been complaining. These executives are also concerned that ArchiSurance may not meet the targets for revenue growth.

Upon hearing about these issues, the ArchiSurance Chief Information Officer (CIO) hired a consultant to design a new mobile infrastructure for broker interaction. This infrastructure is required to enable easier communication with ArchiSurance brokers in order to help the company increase its market share with each of them and consequently attain its targets for revenue growth. In order to ensure that the new infrastructure would meet these goals, the CIO told the consultant that the new infrastructure must make it easy for ArchiSurance to develop and deploy applications and content for its brokers. It must provide federated authentication and an encrypted communication channel as well as instant messaging and presence services.

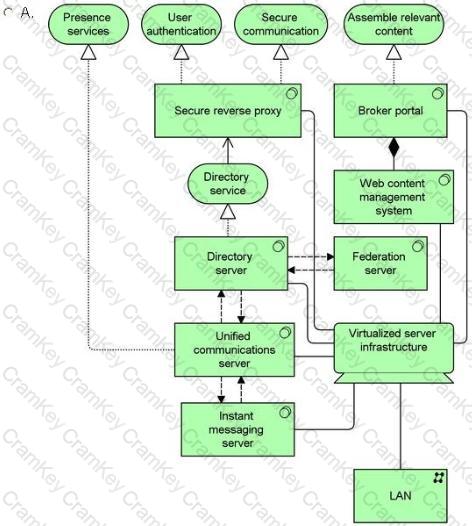

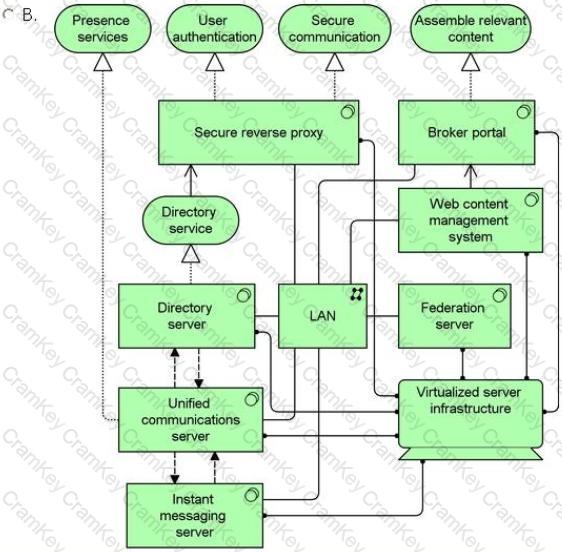

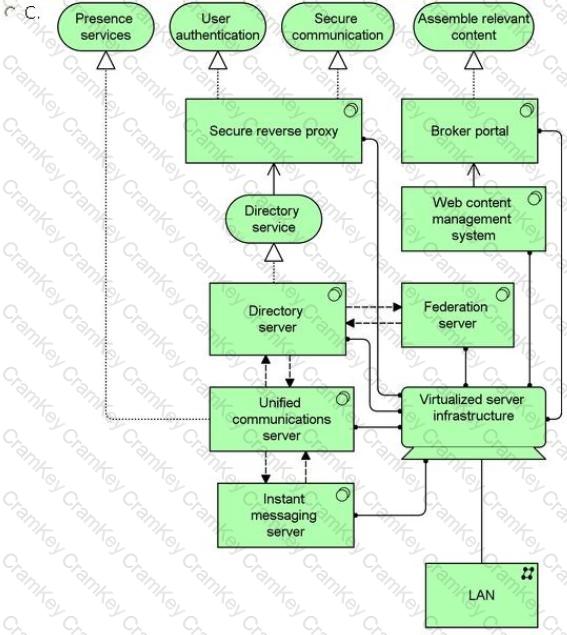

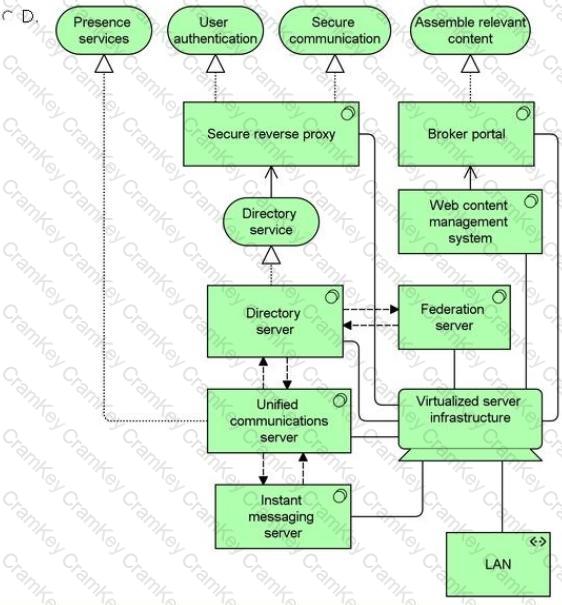

The new mobile broker interaction infrastructure architecture includes a number of system software components. A secure reverse proxy authenticates users and provides an encrypted channel to communicate with them. The proxy uses a service provided by directory server software to authenticate users. The directory server communicates with the ArchiSurance federation server, which in turn communicates with peer federation servers hosted by trusted brokerage organizations. Once the user is authenticated, the ArchiSurance broker portal uses the ArchiSurance web content management system to assemble authorized and relevant content for each broker. In order to provide presence services, a unified communications (UC) server exchanges information with the directory server and an instant messaging server.

All of these components are hosted on a single physical hardware platform hosting a virtualized server infrastructure. The server infrastructure is connected to a converged local area network (LAN), which is also connected to a commercial wide area network (WAN) over which ArchiSurance communicates with its brokers.

Refer to the Scenario

The head of IT infrastructure engineering has asked you to model the ArchiSurance infrastructure for broker interaction. You must show the system software, network and server components and the flows between them. You must also show the services that the system software components provide. It is not necessary to model the wide area network (WAN) or the components hosted by ArchiSurance brokers.

Which answer provides the most complete and accurate model?

Scenario

Please read this scenario prior to answering the question

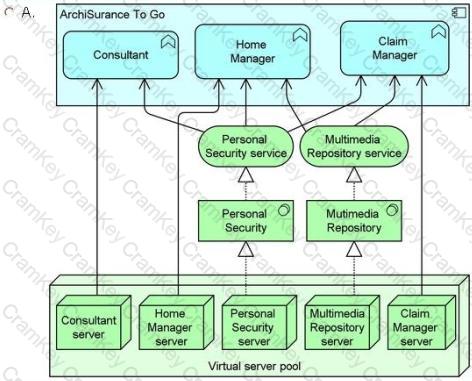

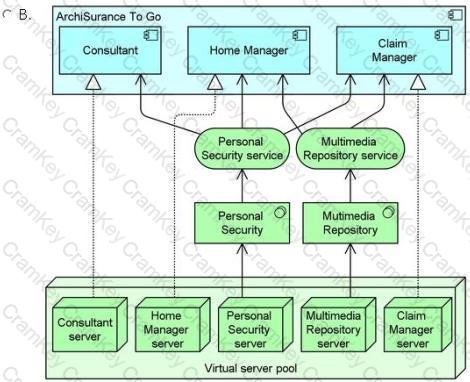

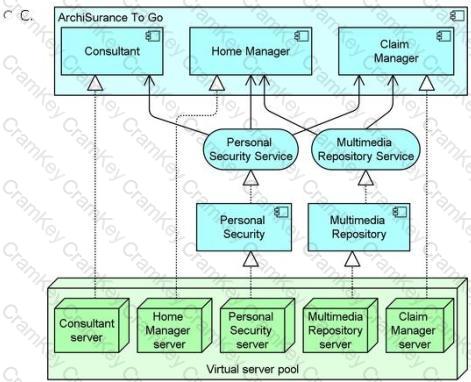

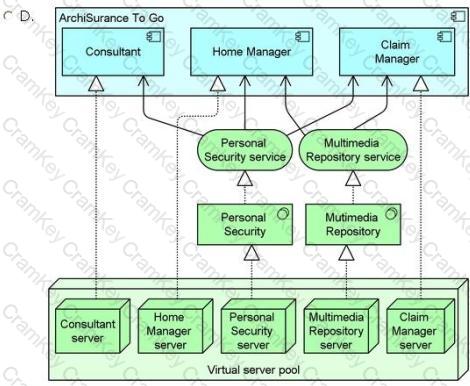

The ArchiSuranceTo Go mobile consumer solution is increasingly important to ArchiSurance, which uses it to sell and renew insurance products, provide customer service, enable accurate and convenient home recordkeeping, and capture and process claims. The solution consists of three components. The Consultant lets customers review their existing coverage, and update it based on common life events, such as getting a new car, moving into a new home, or having a family member move in or out. If necessary, they can speak or chat with a customer service representative. The Home Manager helps customers photograph and catalogue their valuable possessions in order to support the filing of accurate claims in case of loss or damage. The Claim Manager enables customers to quickly file a claim for loss or damage to an insured auto, home or possession. It enables customers to describe the incident by referencing information captured with the Consultant and the Home Manager applications. In addition, it allows the customer to add photographs, audio, video and text to support a claim, submit the claim, and monitor its progress.

The ArchiSurancetoGo components rely on a number of application services hosted by ArchiSurance. The first is an Auto Identification and Description (AID) service that the Consultant uses to validate and complete auto information entered by customers. The second service, Home Identification and Description (HID) performs the same function for home information, and is used by the Home Manager. The Consultant also uses the Virtual Agent service to guide customers as they select coverage options, the Payment Processor service to arrange premium payments, and the Coverage Activator service to generate policies and put them in force.

ArchiSurance to Go also relies on a number of infrastructure services. The Home Manager uses a Multimedia Repository service to store and retrieve information about insured homes. The Claim Manager also uses this service for claim information entered by customers. All three components of ArchiSuranceTo Go use a Personal Security service to register and authenticate customers, and to manage their profiles.

Each application service is realized by an application component with the same name. Also, each infrastructure service is realized by a system software environment with the same name. ArchiSurance hosts both the application components and system software environments in a virtual ized server pool within its data center. Each service has its own virtual server. Each server is connected to a data center network (DCN) which in turn connects to a commercial wide area network (WAN).

Refer to the Scenario

The new head of IT infrastructure would like a better understanding of the applications used by ArchiSurance to Go mobile solution and the hosting infrastructure that supports these applications.

Which answer provides the best description of the applications and their underlying infrastructure? (Please note that it is not necessary to model the networks).

Scenario

Please read this scenario prior to answering the question

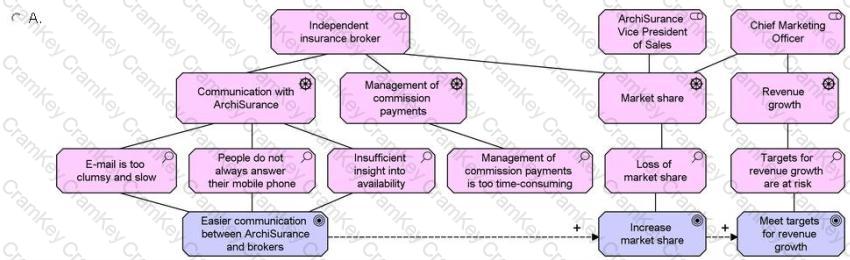

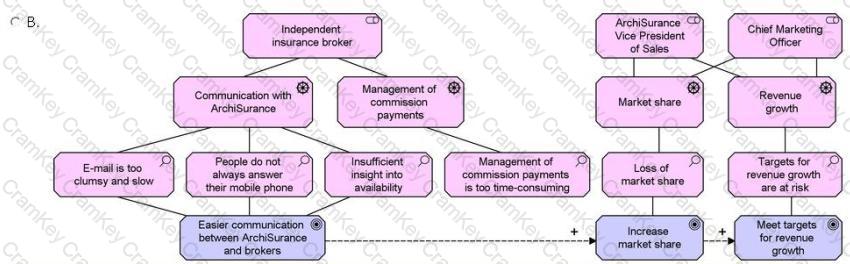

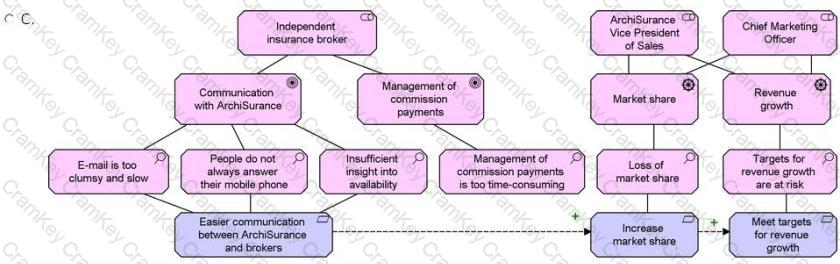

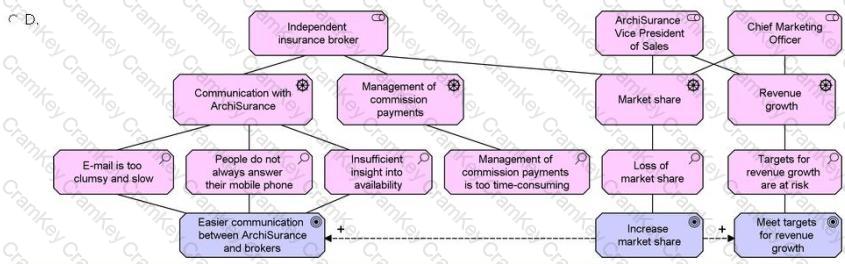

Independent insurance brokers that work with ArchiSurance have complained of difficulty in communicating with salespeople and other personnel at ArchiSurance. They have said that email is too clumsy and slow for working on urgent deals, people do not always answer their mobile phones, and it is difficult to tell whether an individual is available. They have also complained that it is too time-consuming for them to manage their commission payments using an older web application that requires them to print out and mail forms for making some routine changes, and also does not work on many mobile devices. Some brokers have said that it is easier to do business with ArchiSurance competitors that provide easy-to-use mobile applications for both general communication and commission management. In fact, the ArchiSurance Vice President of Sales and Chief Marketing Officer have both expressed concern about reports from the ArchiSurance market research department that the company is gradually losing market share withsome of the same brokers that have been complaining. These executives are also concerned that ArchiSurance may not meet the targets for revenue growth.

Upon hearing about these issues, the ArchiSurance Chief Information Officer (CIO) hired a consultant to design a new mobile infrastructure for broker interaction. This infrastructure is required to enable easier communication with ArchiSurance brokers in order to help the company increase its market share with each of them and consequently attain its targets for revenue growth. In order to ensure that the new infrastructure would meet these goals, the CIO told the consultant that the new infrastructure must make it easy for ArchiSurance to develop and deploy applications and content for its brokers. It must provide federated authentication and an encrypted communication channel as well as instant messaging and presence services.

The new mobile broker interaction infrastructure architecture includes a number of system software components. A secure reverse proxy authenticates users and provides an encrypted channel to communicate with them. The proxy uses a service provided by directory server software to authenticate users. The directory server communicates with the ArchiSurance federation server, which in turn communicates with peer federation servers hosted by trusted brokerage organizations. Once the user is authenticated, the ArchiSurance broker portal uses the ArchiSurance web content management system to assemble authorized and relevant content for each broker. In order to provide presence services, a unified communications (UC) server exchanges information with the directory server and an instant messaging server.

All of these components are hosted on a single physical hardware platform hosting a virtualized server infrastructure. The server infrastructure is connected to a converged local area network (LAN), which is also connected to a commercial wide area network (WAN) over which ArchiSurance communicates with its brokers.

Refer to the Scenario

The solution delivery team for broker interaction would like to get a clearer idea of the motivations behind this solution as they plan a second release. You must model the stakeholders, drivers, assessments and goals that shape this strategic initiative. You must also show the relationships between these motivational elements.

Which answer provides the most complete and accurate model?