| Exam Name: | CMA Part 2: Strategic Financial Management Exam | ||

| Exam Code: | CMA-Strategic-Financial-Management Dumps | ||

| Vendor: | IMA | Certification: | CMA Certification |

| Questions: | 124 Q&A's | Shared By: | priya |

Amy Curtin sells used cars of a reliable bona Curtin has no knowledge of me history or any or the specific cars She believes that the brand is reliable, and is considering whether it is acceptable to offer only this general Information rather than specific information regarding me cars when trying to complete each sale The company has always preferred to make the sale and worry about any warranty issues later and there are no legal disclosure requirements in their jurisdiction Curtin considers herself to be an ethical person but she does not want to lose out on any potential sales of vehicles that are most likely in good mechanical condition Which one of the following statements best represents what Curtin should consider related to the meaning of ethics?

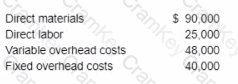

A company produces 10,000 units of Product A monthly at the costs shown below.

The company estimates that 30% of the fixed overhead costs allocated to Product A are avoidable if the company chooses to outsource the production If the company purchases Product A from an outside supplier for $18 per unit what would be the net effect on its operating income?

Mow many student enrolments per year ate required for the new busmen English course to break, even at its current price? Snow your calculations

Essay

Online Learning Inc. lOLI) is a privately-held company based in the IUC that specializes in providing online courses in English as a Second Language (ESL). OLI is trying to set up a new sales office in a foreign country. It needs a business license to operate in that country. The license normally lakes six months to obtain. An official of that country said that he could expedite the process for a fee of €300.

OLI estimates the new sales office can bring €300,000 incremental profit annually OLI has just launched a new online 40-houi course to help adult ESL learners master basic business English. The price of the new course is €500 per student, the variable cost is €300 per student, and the total fixed cost of the new course is €300.000 per year OLI spent €200.000 to develop the new course before launching it. There are many online course providers in the marketplace, and each has its own feature However, OLI's highly qualified staff and good reputation have enabled it to charge a premium price compared to its major competitors. Recent market research indicates that if OLI raises the price of its new business English course by 10V the student enrollment would decrease by 5V A regional airlines company in Asia has approached OLI and offered to enroll 1.000 of its employees in the new course if OLI would agree to a special price of €350 per employee If OLI accepts this offer, an additional €10,000 onetime cost would be required to temporally expand its capacity to accommodate the new students.

Discuss whether AMI should use a cost-based or a market-based pricing approach. Explain your answer.

Essay

Food Depot Ltd, (FDL) is a privately-held company that provides catering services to airlines and operates several restaurant chains including fast food, casual dining, and fine dining restaurants, FDL has been profitable in recent years and has a very strong cash position. FDL's newest division. Food_TO-Go is an online meal ordering and delivery platform acquired by FDL two year ago.

In 20X7, sales for the entire company were $1 billion, with 50% of the business coming from the Airline Catering division. FDL is the country ‘s leading airline catering services provider and control 60% of the market share. However, the outlook of the airline catering industry is gloomy. The compound annual growth rate of the industry for the past five years was only 0.5% as airline networks have increasingly dropped catering on short domestic flights.

The Food-To-division only contribution 5% of FDL’s total sales in 20X7 and is far behind in competing for marketing for market share of the online meal ordering and delivery industry, it is estimated that Food-To-Go’s sales were only 20% of the industry leader’s sales. However, the outlook for the online meal ordering and delivery services industry is bright. The compound annual growth rate of the industry since it started three years ago was 50%. It is estimated the rapid growth of the industry will continue in the foreseeable future.

Susan Willey, the head of Food-To-Go, does not agree that the Airline Catering division is the best-performing division in the company. Wiley argues that ber division bad the highest ROI in 20X7, and it deserves more capital finding. FDL’s requested rate of return is 12%. The selected financial data for the Airline Catering division and Food-To-Go division in 20X7 are as follow (in $ millions)