| Exam Name: | Advanced Management Accounting | ||

| Exam Code: | P2 Dumps | ||

| Vendor: | CIMA | Certification: | CIMA Management |

| Questions: | 202 Q&A's | Shared By: | hubert |

Juan is looking to invest in the mining industry. He has narrowed his options down to two rival companies, both with sales of £200m. Company A has an EBIT of £10m whereas Company B has an EBIT of £14m.

This would suggest that Company B is the better investment but Juan is suspicious that Company B has more financial backing than Company A.

Which ratios will tell him which company will use his investment the best?

A manager must decide which one of three projects should be implemented. For each project the possible outcomes and their associated probabilities can be estimated reliably. The manager has decided to make the decision based solely on which project has the highest expected value of profit.

Which of the following statements are correct?

Select ALL that apply.

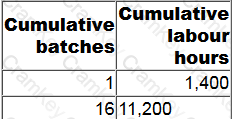

A company has just completed the production of the first 16 batches of a product. A learning curve has been observed throughout. The following table gives further details.

To the nearest whole percentage, what rate of learning is implied?

A company has invested $500,000 in developing a new product and requires a return of 12% on this investment.

The company has researched the market and has set the selling price for the new product at $300 per unit. At this price, sales volume for next year is forecast to be 500 units. The forecast unit cost is $210.

What is the target cost gap per unit for the coming year?

Give your answer to the nearest whole $.