| Exam Name: | Fundamentals of financial accounting | ||

| Exam Code: | BA3 Dumps | ||

| Vendor: | CIMA | Certification: | CIMA Certificate |

| Questions: | 393 Q&A's | Shared By: | dahlia |

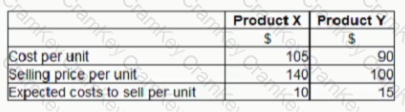

AB sells two products ,X and Y. The following information was available at AB’s year-end, 31 December 20X6:

At 31 December 20X6 AB held 800 units of Product X and 400 units of Product Y

What is the value that will be included in inventories in AB's statement of financial position as at 31 December 20X6?

Which of the following are examples of indirect costs for a chocolate manufacturing business?

Refer to the Exhibit.

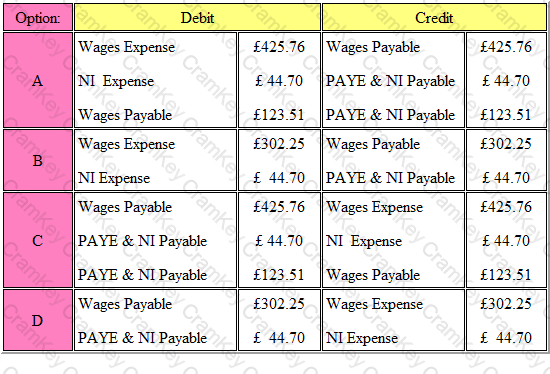

John, an employee of Kelt Ltd, earns gross wages for a week of £425.76.

Income tax is deducted at a rate of 25% on all earnings in excess of £85.00 per week and he is also liable to pay National Insurance contributions of 9% of his total earnings. Employers national insurance contributions are at a rate of 10.5%.

What are the correct ledger entries in the accounts of Kelt Ltd?

The answer is: