Strategic Case Study Exam 2021

Last Update Apr 25, 2025

Total Questions : 45

To help you prepare for the CS3 CIMA exam, we are offering free CS3 CIMA exam questions. All you need to do is sign up, provide your details, and prepare with the free CS3 practice questions. Once you have done that, you will have access to the entire pool of Strategic Case Study Exam 2021 CS3 test questions which will help you better prepare for the exam. Additionally, you can also find a range of Strategic Case Study Exam 2021 resources online to help you better understand the topics covered on the exam, such as Strategic Case Study Exam 2021 CS3 video tutorials, blogs, study guides, and more. Additionally, you can also practice with realistic CIMA CS3 exam simulations and get feedback on your progress. Finally, you can also share your progress with friends and family and get encouragement and support from them.

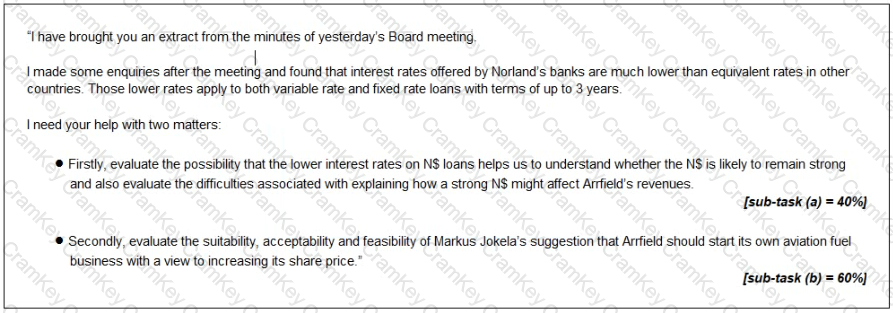

A week later, Romuald Marek stops by your workspace and hands you a document.

The Board minute extract from Romuald can be viewed by clicking the Reference Material button above.

Reference Material

Board minutes extract: proposal to profit from ongoing strength of NS

Anna Obalowu Sole, Chief Operating Officer, reported that the strong NS was helping generate revenues from fuel sales. Discussion followed as to whether the strong N$ was likely to persist and whether a strong N$ benefits Arrfield overall.

Markus Jokela. Chief Executive Officer, stated that the Board should develop contingency plans that could be implemented if it seemed likely that the strong N$ would persist. In particular. Arrfield need not renew the contracts that permit aviation fuel suppliers to operate from its airports. Arrfield would then be free to create its own fuel sale business, buying fuel in bulk to replenish the storage tanks at each of its airports in Norland and then selling it directly to airlines He stated that this would almost certainly enhance Arrfield's share price

Romuald Marek reminded the Board that four of Arrfield's six airports are located in Norland and that those airports charge for aeronautical and non-aeronautical services in N$.

Two weeks have passed since the article about Wodd’s role in tax avoidance was published. Thankfully, the initial reaction was to condemn the celebrities who invest in tax avoidance and little was said about Wodd’s role in facilitating tax-efficient investments.

You have received the following email from Sarah Johns, Marketing Director:

From: Sarah Johns, Marketing Director

To: Senior Finance Manager

Subject: Forestry certification

Hi,

I am told that you would be a good person to talk to concerning the practical implications of a new venture that has been proposed.

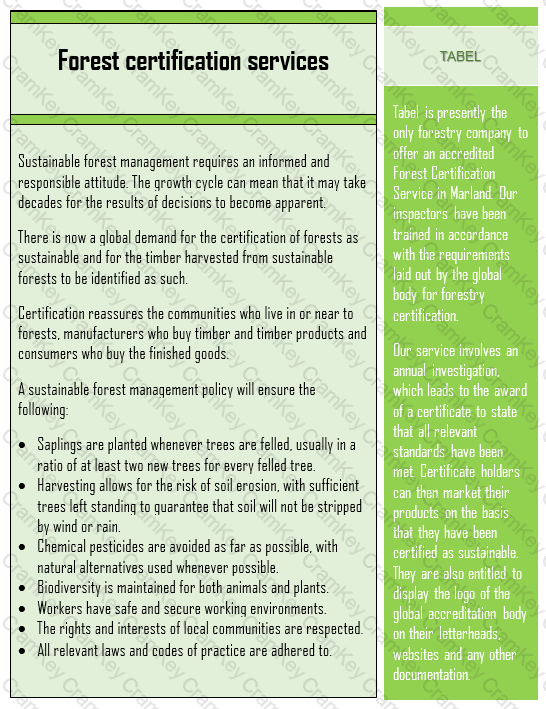

I have attached a sales brochure that I downloaded from Tabel’s website. Tabel is a competing forestry company that has similar interests to our own. It has recently launched the certification scheme that it has described in its brochure. It has no competition for this certification in Marland because no other company has sought the qualifications required to offer an accredited Forest Certification Service.

Wodd has the necessary skills to offer a credible Forest Certification Service. Our forestry managers already aim to exceed all of the requirements set out by the global body. We also have a well-resourced internal audit department. I believe that we could transfer either forestry managers or internal auditors to a new external certification department. The transferred staff would complete the training required by the global body and would sit the associated examinations. We could then compete with Tabel’s service.

I need your advice on the following:

Could you explain how you imagine that a typical certification investigation would work and the skills that it would require? That will help us to decide whether to approach forestry managers or internal auditors and will also enable us to describe the work that they would be doing if they agreed to be transferred.

What are the challenges associated with motivating and evaluating the investigators in the certification service and how might we address these?

Sarah

Reference Material:

Three weeks have passed since you were informed that the relocation would definitely proceed.

You have received the following email from William Seaton, Director of Finance:

From: William Seaton, Director of Finance

To: Finance Manager

Subject: Detailed issues associated with the relocation

Hi,

Congratulations, you are now officially in charge of the transition team! I am confident that you will do an excellent job and that it will be an opportunity to enhance your career.

I realise that the transition team is expected to reduce the pressure on the Board, but I have been asked to keep an eye on things and to ensure that your team has everything that it needs. I won’t interfere, but I will stay in touch.

There are a few matters that I think you should address as a matter of urgency.

Firstly, we need to have plans in place to ensure that our information systems are ready. What changes will we have to make in order to best align the information system with the company’s needs? I am not asking about hardware issues or the physical relocation, but the changes to the information system itself.

Secondly, how might we make use of the data in our own records and external sources to ensure that the new Head Office is managed as efficiently as possible? Remember that the present Head Office is a large and complex operation in its own right and it costs a significant amount to run.

Thirdly, our relocation will create a number of challenges for our corporate treasury team. I need you to identify the key challenges and suggest how they might be dealt with.

Finally, I would like you to identify the criteria against which the success or failure of your team will be judged once the transition is complete. I need your recommendations to be relevant and measurable.

William

Reference Material:

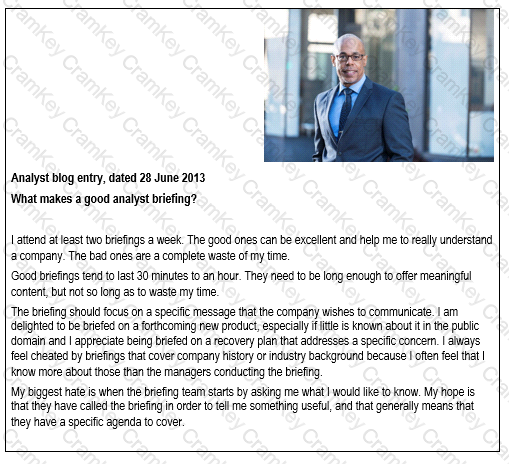

Wodd’s Chief Executive, Peter Sorchi has stopped you in the corridor:

"This weak USD is really causing us some serious problems. I think that it is only a matter of time before the stock market starts to get nervous and I am worried that our share price will fall in the near future. Thank goodness it does not appear to have fallen by much so far.

I would like to brief the Board on two main issues tomorrow. Firstly, what can we do as a Board in order to minimise the negative impact of the weak USD on our share price? Secondly, we know the identities of the key investment analysts who deal with our industry. Would it be a good idea for us to brief them? Please also consider the ethical issues arising from both of these topics as well as the more technical matters.

Please let me have a copy of your briefing notes in advance. I need to be able to sound convincing at the meeting. I’ll also have my secretary refer you to a really helpful blog."